Vehicle purchase by financing is the reality of car ownership for most Malaysians. As a result, many consumers think of vehicle ownership cost purely on the basis of monthly instalments whereas the reality is that owning a car incurs many hidden costs that are not always printed on brochures.

Statistics from Malaysia’s Department of Insolvency released in January show that between 2007 and 2014, vehicle hire purchase was the leading cause of bankruptcy among Malaysians.

During that period, 39,082 Malaysians went broke because of their cars, accounting for over a quarter of total bankruptcy cases in the country. It is therefore very important that you work out whether that dream car you are lusting after is genuinely within your financial means.

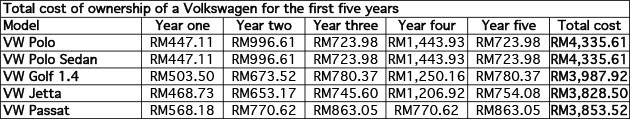

The price you pay for having a car to call your own starts with the downpayment and monthly instalments, but extends to include road tax, insurance, periodic maintenance, fuel consumption, and unscheduled repairs.

Whilst costs due to accidents and breakdowns cannot be legislated for, most other expenses related to vehicle ownership can be accurately scheduled or at the very least estimated. A savvy consumer takes all these factors into account when working out a vehicle’s overall cost of ownership.

Depreciation is a major cost factor to take into account, but that is arguably more valid for buyers with intention of selling their vehicles before the end of their financial tenure.

Although unpredictable by nature, educated guesses of a vehicle’s depreciation can be estimated by looking at examples of the same model available in the used car market. You ideally do not want a car that loses its value faster than you can repay your bank loan!

Another cost item hiding behind your monthly instalment is the bank’s interest. A car costing RM100,000, for example, has the potential of racking up over RM22,000 of interest over a period of seven years if financed at a rate of 3.5% per annum.

Certain car makes offer zero instalment packages for the first six months to one year of ownership, which can help alleviate this particular cost. If your cash flow allows it, consider a shorter financing tenure to reduce your interest payments.

Insurance and road tax are the next constants in your vehicle ownership costing, although in the case of insurance, your premium decreases with the car’s insured value and no claims discount (NCD) if you have any.

Road tax is calculated against engine capacity – this situation favours modern downsized turbocharged engines that require you to pay the road tax of a smaller engine whilst enjoying the power of a larger one.

Volkswagen’s 1.2 and 1.4 TSI engines, for example, pay annual road tax of RM55 and RM75 respectively, whilst producing performance equivalent to many engines that pay between RM280 and RM700 per year. Over a typical ownership span of five to seven years, this translates to savings measured in the thousands.

Smaller engines are also by nature more fuel efficient. Thanks also to the usage of advanced combustion technology, the 1.4 TSI engine installed in a Volkswagen Jetta with 160 PS is capable of matching a typical 1.5 litre Japanese B-segment sedan for fuel economy whilst offering far superior performance.

Periodic maintenance is another very relevant component in the overall cost of maintaining a vehicle. In addition to incurring monetary expense, maintenance also consumes time. Cars with longer service intervals typically incur higher servicing costs at each visit to the service centre, but the flip side is the advantage of reduced vehicle downtime, meaning less time at workshops and more time for your more fruitful pursuits.

In fact, cars that require fewer visits to the workshop might cost even less to maintain, as labour cost is reduced due to fewer workshop man-hours being spent on the vehicle. Authorised service centres typically apply standardised pricing on regular servicing jobs involving changing fluids and swapping of wear and tear parts.

When maintaining or repairing your vehicle, it is always worthwhile to invest in original parts for added peace of mind. Original parts are designed and made with quality optimised for the vehicle to perform as intended by the manufacturer. Bear in mind that a car is a complex network of interconnected electrical, electronic, and mechanical systems. One inferior part in that whole chain can potentially generate knock-on effects that manifest into frightening repair bills further down the road.

If possible, it is a good idea to survey and get to know prices of key spare parts of the vehicle you are planning to buy. Whilst there is no realistic way to accurately budget for every repair of the vehicle throughout the course of your ownership, it pays to have an idea on how much you will potentially need to pay for wear and tear or accident repair items such as brake pads, timing belts, bumpers, light clusters, and others. It also is best not to rely on hearsay when it comes to estimating potential repair costs; some supposedly expensive brands are relatively affordable to maintain.

Owning a car is expensive business and requires continuous expense at various areas. The smart buyer takes all these areas into account when considering the affordability of a vehicle, thus making an informed and well-considered purchasing decision. Your car is the second biggest purchasing decision after your house, so it pays to choose wisely.