The formula used to calculate the price of fuel is called the Automatic Pricing Mechanism (in place since 1983) and its function is to stabilize the price of petrol and diesel in the country to a certain extent, via a variable amount sales tax and subsidy, so the retail price only has to be changed if the difference in price exceeds the threshold of the tax and subsidy, at the discretion of the government.

This is how the price of petrol and diesel at the pump is calculated in Malaysia.

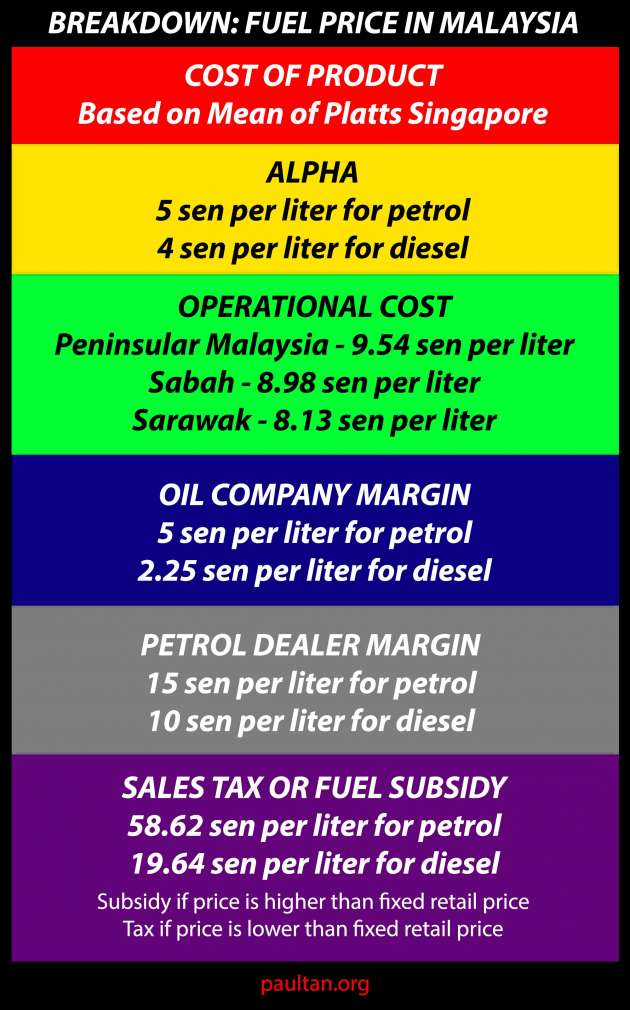

In the table above, you can see that the Cost Of Product is not derived from the price of Crude Oil on the NYMEX, but it is based on the Mean of Platts Singapore (MOPS). The cost is the already refined product, which means the refinery cost are already included and indexed in the MOPS.

You may ask what exactly is the MOPS? Many countries in this region base their fuel prices on the MOPS, including alot of ASEAN countries and even Australia.

The index is tracked, assessed and updated by Platts, a McGraw-Hill company in Singapore and is based on the daily average of all trading transactions between buyer and seller of petroleum-based products.

A buyer of a finished (refined) oil product will refer to the MOPS index as a better indicator/benchmark of world prices rather than crude oil prices. The MOPS price typically has a premium over the crude oil prices. This is why the Malaysian government uses MOPS to determine fuel prices rather than NYMEX crude oil prices. Unfortunately it is hard to track MOPS prices as individuals because the data is only available to those who purchase it, unlike the publicly available charts from the NYMEX.

Next up is “Alpha”, which is fixed at 5 sen per litre for petrol and 4 sen per litre for diesel. This is sort of a buffer for the oil companies. If the price of the product that the oil companies buy is higher than the MOPS published price, and the difference is higher than Alpha, the oil company will bear the extra cost, and vice versa.

Operational costs should be self explanatory. They are set at 9.54 sen per litre, 8.98 sen per litre and 8.13 sen per litre for the Peninsular, Sabah and Sarawak respectively. Operational costs cover transport and marketing costs.

Then comes where the oil companies make money, which is set at 5 sen per litre for petrol and 2.25 sen per litre for diesel.

The stations make more money per litre of petrol – 15 sen per liter for petrol and 10 sen per liter for diesel. UPDATE: This used to be less – 12.19 sen per litre for petrol and 7 sen per litre for diesel, but it was revised to the new rates in 2019 under the Tun Mahathir cabinet.

Sales tax and subsidies are combined. According to the Sales Tax Act 1972 (this is not something new!), the government CAN collect a maximum sales tax of 58.62 sen per litre for petrol and 19.64 sen per litre for diesel. This comes into effect when the real price of petrol and diesel at the pumps are lower than the fixed retail price. The government can pocket this, or it can revise the fixed fuel price to be lower to remove the difference in price so the savings go into the rakyat’s pocket.

On the other hand, if the fixed retail price is lower than the actual cost of the petrol and diesel at the pumps, the government can pay a subsidy of the same range. Right now the government says it will give a maximum subsidy of 30 sen per litre instead of the maximum allowable subsidy of 58.62 sen per litre, IF NEEDED.

This 30 sen maximum subsidy is as part of an improved Automatic Pricing Mechanism, which the Ismail Ahmad says is designed to stabilize fuel retail prices and allow industry players to manage expenditure in a more orderly manner.

Looking to sell your car? Sell it with Carro.

AI-generated Summary ✨

Comments generally express frustration and skepticism about Malaysia’s fuel price calculation mechanisms, often calling the system "fishy" or "idiotic." Many highlight that Malaysia, as a petroleum producer, should have lower fuel costs, questioning the high prices despite dropping global crude oil prices. Some critics argue that taxes, government margins, and subsidies unfairly inflate prices, and compare Malaysia unfavorably with neighboring countries like Indonesia, Singapore, and Australia. Several emphasize the lack of transparency, accuse the government of corruption, or claim that policies benefit big corporations or political interests. Others suggest that the pricing system is overly complex and technocratic, making it difficult for laypeople to understand. Overall, sentiments are predominantly negative, with calls for government accountability, transparency, and fair pricing aligned with global trends.