The affordable MPV segment is one that’s attracting plenty of interest, thanks to the January launch of the Honda BR-V, which has shot Honda to the top of a segment it previously wasn’t present in. The SUV-styled seven-seater enters a market that has the Toyota Sienta, Toyota Avanza and Nissan Grand Livina. Further down the price scale, local options include the Perodua Alza and the Proton Ertiga, launched last year.

All the above bar the 1.6L Nissan have four-cylinder engines below 1,500 cc, and attract excise duty of 60%. That has now been increased by 5% to 65%, according to the “Excise Duties Order 2017” published by the attorney general’s chambers on March 31. This fresh order replaces the 2012 version and takes effect from April 1, 2017.

Unlike import tax, excise duty is levied on all products, whether imported or manufactured locally. This means that the Honda BR-V, Toyota Sienta, Toyota Avanza, Perodua Alza and Proton Ertiga are affected by this move. Alcohol and cigarettes too, if you’re wondering about the increase in “sin tax”.

The Nissan Grand Livina already attracts the 65% rate due to its 1.6L engine, which falls under the 1,500 to 1,800 cc category. By the way, a 1.5L sedan attracts 75% excise duty, so the new rate for budget MPVs is still lower than the average City or Vios.

There have been no announcements from the affected car manufacturers yet, but this points to an imminent price increase. We’ll keep tabs, but it’s wise to “lock in” your purchase before any revision. Compare prices and specs of the applicable models on CarBase.my.

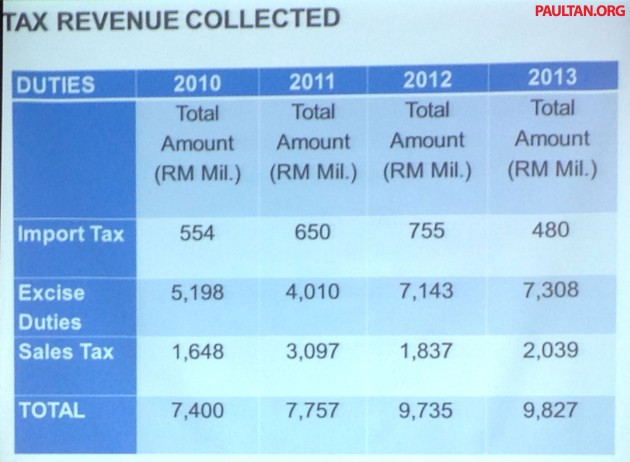

The government, via the ministry of international trade and industry, has previously said that there are no plans to scrap excise duties. Import taxes have been on a downward trend, thanks to the many free trade agreements in place, but excise duty is the prerogative of the government.

“The auto sector is a very important contributor to the government’s coffers – 75% of the duties collected from the auto sector comes from excise duties,” MITI minister Datuk Seri Mustapa Mohamed said in 2014.

“On excise duties, the position of the government is as follows. Given the current situation of the budget, it is not possible for the government to review excise duties, but the government, of course, in the next few years, will review the fiscal situation. And as the fiscal situation improves, the government will consider looking into the possibility of gradually reducing excise duties,” he added then.

Based on that statement, as the economy is not rosier now than in 2014, there’s no possibility of excise duties going down from present rates. Up? Always a chance.

Looking to sell your car? Sell it with Carro.

Cukurr 5% saje. Gahmen prihatin..

“In five years time the government plan to lower down the car prices as much as 30%..”Najib said.

This was PM promised 5 years ago before GE 13 election but reality was the prices went up every year.

“Hey Jibby!”

“What?”

“Eat my foot”.

“Ok”.

Malaysians suffer with high cost of living but Ministers live luxurious lifestyles. All hidup mewah. Only country in the world where Ministers can own Ferrari and Lambo in their house whilst still holding office.

Cukur betul

STOP buying new cars.

When new car sales dip,they will collect less duties.Also,after 6 months,distributors will start giving rebates before Christmas.

Jom,let us visit used car dealersn take the best bargain.

START buying local cars to save more

STOP complain about our gov

START buying local cars to save more

PT why post comments slow?

Rakyat susah tapi aunti gemuk milik berpuluh puluh beg tangan Birkin berharga RM500k sebiji

Fake posts copy and paste.

All the BN bum lickers just got a shock of their lives. Ha ha ha. They just realised they have been conned

so many penyokong gomen today butthurt. All shocked their beloved gomen raised car prices. Wait this week. Another shocker. Petrol going up by 25 sen.

Semue barang naik, Gaji takde naik.

Ini semua salah Boss sy….Oh wait sy ialah sorang Guru.

Perodua, Honda & Toyota command 75% of Total Sales volume in Bolehland.

Why pipu here complain? It is only 5%! Infact, I am even ready to pay 10%. Oh wai!

Why jus stop at 10%???

Hentam 100% or 500%….

Rakyat didahulukan, bukan?

Beli Proton no suffer lah

negatif sangat dekat proton, ingat proton x kena cukai ka

Taknak P1!

Only you said that

If, I repeat “if”, all the FSP back out like Geely, P1 can kolos shop anytime, then those current P1 owners will suffer 99, worse for new P1 owners, warranty semua hilang. What are the possibilities huh?

Why so many thumbs down? Beli Proton suffer meh?

Another misleading news. List down all Ministers who own Ferrari and Lambo in their house as u said.. i really want to know this!!! I bet you cant :)

katak di bawah tempurung! How long you want to deny?

This basher with multiple names got no life. Pity him. Acting like small kid.

Bukan mentri sahaja, anak Menteri pun pakai Porsche. Anak Nazri pakai Porsche Cayenne macam mana? Tak kerja tu

HInda brvb sales wont get impact with this

Agreed. BRV sales is still going strong. Now the waiting list is crazy.

jaguh kampung kunyit blind

Nazri and son own Lambo and other luxury car using proxy…

Yes Honda BR-V sales won’t be affected but their profitability will for those prior month’s thousands of bookings. But then again, Honda Malaysia have deep deep pockets, so its like kacang putih right?

Thanks to them (Honda), our govt decides to increase our Excise Duties.

ministers in malaysia are businessmen..gomen job is only part time..

mostly are contractor before joint politic to get easy project.

Ini lah akibat kecurian banyak banyak…kerajaan sudah boros. Hospital pun tak ada ubat.

Jangan merepek. Ada bukti tak?

jika begitu jokowi dikirim saja ke malaysia jadi perdana menteri. Lengkap dengan mercedes s600 w221-nya yg sering mogok

This is tipu rakyat, where is 30% car price reduction promised BN. After Honda announced surprisingly top-sales from 7-seated BR-V, MITI immediate action from seeing the potential source to suck the bloody hard-earn $$$ from rakyat, the 7-seated car segment, targeted the $$$ from family with >3kids. Now you seeing Hollywood Drama from miti.mai.maa, from previous cheating 30 millions msian by blaming the auto makers of not reduce the car price but the TRUTH is actually duty/tax not reduce but *increased, beside EEV Incentives under mai.maa which another nasi.lemak.teh.tarik break time drama. Pity 30millions msian that paying excise.duty (75%), CKD/CBU.duty(30%), Sales.Tax.GST (6%) that total-up ~210% from actual car selling price, just for a daily basic need * transportation.

dont forget the Bentley and S400 Hybrid too. Their gaji only RM12k. Tapi masih boleh beli Bentley

No la, later someone may jump out and say that is gov asset. Own by gov so gov paid.

Wah you think it’s that simple ah? Can do jump jump and say say like that

Ptuuuuuuuuiihhhhh

Kerajaan bankerap. how to make money? Everyday got 10 meetings and all meetings minum teh only

What meeting is that?

apa lagi Along mahu??!!!!

Datuk Sri, what happened to your GE13 promise to bring down the vehicles prices. Say what you mean and mean what you say.

Pls check latest price of Subaru Forester before bashing

VW and Subaru not meh?

Stop bashing our Gov

Yes that’s what you get for not buying Proton Ertiga. Please choose wisely. Go Proton! – Faiz Roslan CEng

Yes that’s what you get for not buying Proton Ertiga. Please choose wisely. Go Proton!

Go Go Go Proton… save RM20k, but need to add more RM200k for hospital bills (if you not mampus yet) due to no VSC. Poodua Alzaik, no need to say lar, once crash (which is much more easier than Ertiga) high chance occupants already ‘cremated’ inside.

Nowadays to die also better in jepunis cars?

ATTENTION CITIZEN OF MALAYSIA! FUEL PRICE FOR NEXT THURSDAY ARE CONFIRM TO BE INCREASED ANOTHER 25 CENT AFTER THE WORLD CRUDE PRICE JUMPED AMID UNCERTAINCIES ON STOCK MARKET SINCE U.S. ATTACKED IN SYRIA.FILL UP YOUR TANK NOW AS THE U.S WILL EXERCISE ANOTHER STRIKE IN FEW DAYS.. DON’T BE STUPID BY THINKING NAJIB WILL SPARE YOU FROM THE NEXT INCREASE,BUT ONLY YOU CAN SAVE YOURSELF.

BS. Have faith in my mentor. My supreme leader will lead u to liberation…

True bro tongue twister4

OMG that is crazy. Those who buy Alza are from the lower income group. All susah payah. Some even work 2 jobs a day. And yet our beloved gomen want to increase 5% excise??

And Ertiga got ZERO sales. 1 year launched, many people have never seen a single Ertiga on the road. Now with the increase in price, who will buy Ertiga? And how is Proton going to pay the few hundred million ringgit royalty payment to Suzuki Japan for the rights to rebadge Ertiga?

I earn almost 10k a month and i drive an alza..

10k nowadays is not good income anymore, bro..

Low income group then why have so many kids till you need a 7 seater? sial sendiri bawak. so don’t complain.

Tasek Gelugor MP says can woh

Haha ertiga ugly as heckRather buy other alternative instead

Sienta is uglier, lol

Ertiga ugliest and no VSC

Err how about nissan go+?

Budget market is where the volume will come from thus the money will surge in. Too bad though since this segment is where the people suffers the most, low income families now have to rely on 15 years old Unser or just overload their BLM Saga.

Already Malaysians are paying the highest car prices in the world. To make matters worse, due to corruption, our GDP per capita is one of the lowest in the world. What this means is our pay packet is one of the lowest in the world.

Compare this to Singapore. Singapore GDP per capita is the highest in the world. Average gomen servant in Singapore earns SGD8000 (RMRM26,000) per month.

Average Putrajaya gomen servant earns RM1200.

Compare RM1200 vs RM26,000

Toyota CHR Hybrid in Singapore is SGD65k. COE is SGD35k. Total SGD100k for a CHR Hybrid.

When CHR is launched in Malaysia, it will be RM150k. How earning RM1200 can afford such car?

Current COE for cars up to 1.6L is SGD51K & above 1.6L is SGD54K. Personally I feel CHR is overpriced in Singapore. Parallel importer dealers are selling 1.2l turbo from SGD135k and from SGD116K for 1.8l variant.

With RM500 enough to spend 1 month they said,

5% tax is just a small amount they said,

No money eat kangkung they said.

Bullshit everyday makes me wonder if they really have a good education background, or just buy the title?

Our car prices are so cheap, don’t know why pipu here bising for just 5%????

Oh wai!

who wants to buy silly CHR or HRV? We got Saga. Much better car. cheap and economical….oh wai!

U don’t like u can always move to Sg

Dude, if you want to bash the gomen, bash with real fact not with your fantasy fact! Since when Singapore GDP is highest in the world? And since when Malaysian GDP is one of the lowest in the world? Pls la get ur fact right and stop spreading false news. A simple google also will tell the truth. In ASEAN itself, Malaysia outranks Singapore. Pls la.. Tlg la.. Rakyat Malaysia tak bodoh. But I wonder those “106” who like your comment is what…. This is an era where we should be more educate dude…

ha ha ha ha “Malaysia outranks Singapore”

According to IMF data, Singapore No 7, Malaysia No 62. How does Malaysia outrank Singapore?

https://en.wikipedia.org/wiki/List_of_countries_by_GDP_(nominal)_per_capita

Better buy the mpv now before price increase

Is this why 1 Sing Dollar is RM3.30? Outranks?

Ppl said “… one of the lowest in the world”, you translate to lowest in the world!

Than you mock google saying M’sia outrank Sgp!

Rakyat M’sia tak bodoh … segelintir only. That’s the reason you still got likes!

why are you still in Malaysia then? If you still in Malaysia

Dude, if you want to bash the gomen, bash with fact not with your fantasy fact! Since when Singapore GDP is highest in the world? And since when Malaysian GDP is one of the lowest in the world? Pls la get ur fact right and stop spreading false news. A simple google also will tell the truth. In ASEAN itself, Malaysia outranks Singapore. Pls la.. Tlg la.. Rakyat Malaysia tak bodoh. But I wonder those “106” who like your comment is what…. This is an era where we should be more educate dude…

Paultan, this is a resubmit comment as I dont see my comment being published yet but others are already being published. I am asking you WHY? Paultan, you as a Media platform should have the responsibilities to make sure that no false news are written over your platform!

No need to be cry baby. Paul Tan will publish your comment. Whole day today 8/4/2017 until 10pm nobody’s comment got published. You posted at 11am. So why are you lying others got published?

They dont care. No different with bashers.

I also simple google and saw Singapore outranks Malaysia by far.

Wow Kunte Kunyit, you over thumbs up bro. Within 30 minutes can go from 10 likes to 139 likes

Agreed. Club kunta thumbs up like crazy.

meanwhile u and john oughta stop taunt people.

he said ‘gdp per capita’.

GDP per capita – Spore wins. GDP growth rate- Malaysia wins over Spore, smart-s. A simple search in Google would confirm the fact.

pls la…tolong la….u internet warrior cum keyboard warrior…this is an era where we think first before going off with our mouths or in this case, with ur keyboard.

Ee Tze, Spore car prices ARE overpriced!

Hey man. Go apply in private job in singapore. They love us if we are great. I heard that is why singapore private job are full of foreigners not only malaysians.Because their own people rather work with Goverment because of the 8k you mentioned that private wont ever offers. This from my sister working experience 10 years in singapore. Unlike malaysia is opposite of private more locals than foreigners excluding laborers.

Singapura BMW 330e CBU is $170k

Mesia BMW 330e CKD is RM$249k. Harga tax free ni!

Your number all salah, probably never step foot in singapore before. 8k average haha.

Actually supreme leader nak naikkan 50%, but he understand our suffering, so increase 5% only.

Cukuuur

So actual car price 0% tax like Saga, Myvi is only Rm15K??

Buy toyota & Perodua better! Dont buy Proton, KIA, Hyundai & Chevrolet! Bad RV. Expensive spare parts!

Since when it is expensive?

one way ticket on a one way street

Kat sini kitorang panggil Jalan m_____

I want to see what john says. Where is he today?

The government is really broke huh? Like MC Hammer broke

Tax the rich so no problem.

Cant touch this

So shy. Rich country with resources but sudah muflis

Said who? Your parents?

The beloved gov will try every way to sucks the people hard earned money, bloody hell…

I am happy to pay more. It will be used for our own good

yes john i know who you are.. pls. be yourself. don’t simply put a name which is not belong to you. People now days educated, so rakat know which is true or false… as for you even don’t own a proton or can’t afford it, so pls. you just shout out and stop shitting here n there….n be who u r, be a man!..

Hidden due to lowcomment rating. Click here to see.

Kangkung turun kerajaan turun.

U pandu kangkung gi kerja la

Betul… Bashers only know how to bash our Gov

Kami tkpuji gomen pasal org yg pakai kancil mcm kau ade utk sokong jibi-raun..

No relation at all. Kesian, sel otak tak berhubung

seriously bro?

Kita nampak harga naik banyak daripada harga turun! Lagi suka roti canai… Pusing sana sini bila rakyat tanya soalan. Macam baru baru kes tu…

Kangkung jer. Mana ada orang makan kangkung tiap tiap hari. You ke?

Ha ha…tax the affordable, while the poor remains poor. The rich will use the company’s money to spend on these depreciating assets. Lucky you the affordable, the banks are always willing to give IOUs. If you feel the pinch, you know what to do come election time.

Why keep taxing the middle income and the poor people?

GST is already a burden.

Why can’t the Gomen tax the rich more instead? Double the lambo and Ferrari tax for all I care, keep the budget cars affordable please.

Penipu.Dulu cakap nak turun harga kereta. Kerajaan penipu !!

where are all those BN supporters? lost their brain somewhere? still kissing the BN butt? ops…

must shiok sendiri in the toilet.

Malaysia thank you bunch of idiots and baboons.

Bijan : ramai betul rakyat beli Mercedes, BMW, Honda. Dah tak laku da proton.

Best keter baru korang? Banyak duit korang.

Nak aku naikkan cukai, baru padan muka korang?

This is what happen when you vote this kind of idots to the parliment…

Eh diorang nak shopping before election comes, kena kumpul dana Mega Sale 2017. Shopping oversea. Currency Dah naik

Huaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaa

WOW WHAT HAPPEN TO REDUCING CAR PRICES AS PROMISED BY LAST GENERAL ELECTION??

tax car, tax tourist, tax everywhere….. YEAH!!!

Good laa.. our government know how to korek duit from rakyat.

We ar high income people so must help our gohmen to best in d world….say our corrupt politicion

Pandai betul guna peluang…cukurrr

What the….? Even for Alza? Ini baru kurang ajar…

Ini memang bangsat punya kerajaan. Haramjadah

Adat ke mana?

And yet many stupid idiots will still vote for the incumbent come next elections… Remember the 30% decrease promise last time?? I hope malaysians now realise that those in gov’t DO NOT HAVE their best interests at heart at all!! As a matter of fact, they actually hate the fact the malaysians can own cars now so the roads are jammed and they cannot drive their luxury cars as fast as they want LOL

Before the last GE I remember the government wanted to reduce taxes on vehicles but yet here is an instance where it is going up. I don’t really observe politics but I cannot vote for the ruling coalition on the count of this transgression.

janji dicapati

And all the hate to Mazda for increasing their prices earlier than everyone else. People just wanna hate as outlet for their frustration

tunggu masa undi

Tengok Nasib kau Ada luck ke tidak

Forget about car price reduce that guy promised us years before yeah..

Stupid policy. Tax the poor. Relieve the rich who buys hybrid at 400k like Volvo et al.

U jelly? Buy Proton if no money

Web sebelah kata itu naik sbb ada masalah sistem. Akan diperbetulkan, katanya

Woohoo. People need to buy cars so let’s make money out of this reality. More cars people buy more money into the coffer faster with the 5% hike. Ka-ching. Ka-ching.

Goddammit!

wow increased on april fool’s day…nice 1 our gomen

Maybe some minister will say:

“tak pa, tak pa…..we will make sure banks will give car loan up to 20 years. okeh?

Janji di capati

Tripple tax from GST . Personal tax now excise duty its a greed hope the car industrie suffer tremdous loss in car sale.

Thank you for piling the taxes on us. We love being screwed daily in order to keep the fat servants happy.

Where got fat? The number to calculate civil servants are different between countries

Pondon govt n pondon tactics with zero leadership qualities.shame on u najis

Modern day cannibalism. Practicing of cutthroat ways.

Can Paul and friends please publish all the taxes that is applicable to all vehicle purchases in Malaysia? High car prices will make people buy the lower variant with less safety features, keep their car much longer than desirable and probably do less maintenance too. Therefore high car prices do contribute to our high rate of road accidents.

Talking about lowering car prices…… (sarcasm mode ON)

In 2013 the Proton Saga SV MT costs USD 11183. Today the Proton Saga 1.3 Standard MT costs USD 8047. That is a reduction of 28%. Very close to the 30% promised during the GE 2013 campaign.

Yes, car price has been lowered.

(sarcasm mode OFF)

Note:2013: 1 USD = RM 3.0 2017 1 USD = RM 4.5

Good one paparadzi…

OT: you still active on MalaysianWings forum?

Spot on. Who says the Gov did not reduce car prices as promise? Just follow my advice and buy Proton

Spot on u tak baca sarcasm mode on… Time to wipe off dedak from your eyes bro

tahniah najib kerana berjaya mengurangkan beban rakyat satu persatu… celaka

Hek eleh 5 peratus pun berkiree!

Kami berterima kasih kepada semua orang Melayu yang mati-mati mahu kerajaan UMNO-PAS.

The future will not be ‘bleak’ if UMNO leads our country

Racism is high in here

Most time bad economy hardly affect kampung folks because their living standard are very low. Now gomen really perah kaw kaw semue dia orang nak. For sure more to come. I’m happy to this especially melayu from kampung start to complain and ranting. So tell me now ketuanan is more important or your living needs? Ge is coming soon. Ini kali lah!!!!

yer

Jangan persoal ketuanan…

Based on all feedbacks received from the poor… the government “will” decide to put the tax increase “on hold”. Undilah kami.

What’s the reason for the increase? Gov no more money is it?

This no brain gov’t only know how to collect money from rakyat..let’s put them into dustbin after GE14 !!

This no brain gov’t only know how to collect money from rakyat

Let them down after GE14

Just a matter of time GST hits 10%

If P1 can’t beat them, ” kasih naik 5%”. Janji lebih berbaloi for G.

see who else will vote you scumbag

Adat ke mana?

Nice one

Best picture

Dont bullshit la , proton and perodua have no excise tax at all except 6 % GST. If you dont believe me go and check the price of proton and perodua at tax free land langkawi and mainland, the only difference is 6% GST. Mana excise duty ? MANA ?

expecting an increase in excise tax for 1.5 non-mpv, 1.3, 1.0 in the future real real soon

If u guys got no money, just buy local car like Proton lah. Bising apa?

good! increase for next round’s brim.

The problem is BR1M receivers just like to complaint our Gov. After receiving the aid don’t even say TQ to Najib

Result from corporatisation of Custom Dept. The more they collect, KPI target achieved, better bonus. GST collections are not enough, need to increase excise duty then target is achieved. Following IRB’s footsteps.

Thank you for helping me decide who to vote in the next election

Sedih…every time tengok news macam ni buat sedih je industry kereta and rakyat. backward…

john is working overtime defending our BN Gov here. Hehehe

He forgot bro, the China debts. Beggars usually the loudest.

Finally someone talk with sense

CAn someone from the government explain why the need to increase??

Our Gov will NEVER explain. That is a Fact & bcos they CAN. If I use logic to explain, U might be able 2 understand.

All taxes be it Service Tax or Excise Duty goes 2 our Gov as a form of income. These income will be use for a varieties of reason which I’m Not going 2 say here bcos i believe U already know by now.

My guess is our Gov is short of CASH & the easiest way is through Excise duty(direct tax) after the recent announcement of BRiM. There U have it. Hope someone can give U a better explanation if they have the time. Cheers

If you all don’t like the 5% increase exise duty, you all boleh keluar Malaysia, okeh??

Now this is something to shut all the gov bashers

What about the loan from China? When is it going to repaid?

Hutang negara dengan Boss China, macam mana nak settle ya?

Aiks…… Bukan turun harga kereta secara berperingkat ke?