In his short-term economic recovery plan speech earlier this evening, prime minister Tan Sri Muhyiddin Yassin announced a host of measures to stimulate the country’s economy, which has been adversely affected by the Covid-19 pandemic.

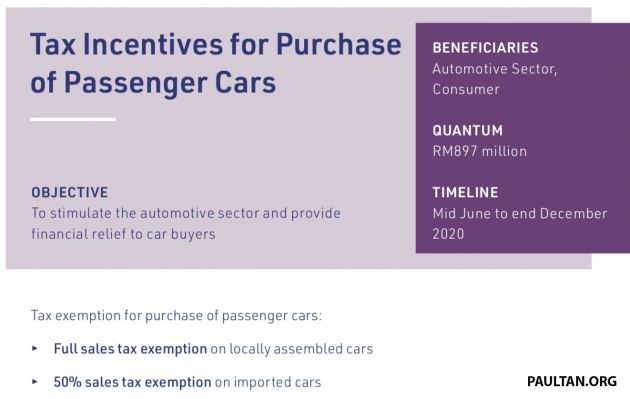

For the automotive sector, these involve an initiative with a quantum of around RM897 million, aimed at boosting new car sales, which will effectively keep the industry moving and provide some financial relief to new car buyers.

The relief measures that were announced under the economic stimulus plan known as Penjana are a 100% sales tax exemption on locally-assembled (CKD) models and 50% on fully-imported (CBU) models, starting from June 15 until December 31, 2020.

The current sales tax rate under the sales and services tax (SST) for both CKD and CBU passenger vehicles is 10%, so for CKD this will mean the complete removal of the 10% rate on all locally-assembled cars for the period, while for CBU it will be halved to 5%.

As such, expect car prices to go down in the same way as it was when the 6% goods and services tax (GST), which was introduced on April 1, 2015 was abolished in June 2018. The result was a three-month “tax holiday” (until SST was reintroduced in September 2018) in which there was zero sales tax imposed on all new car sales. Of course, CKD vehicles will benefit more from this round of the tax holiday.

Seeing as the announcement was made just this evening, price revisions will only come about from next week on. We don’t know by exactly how much car prices will change, given that there are a few variables and differences since 2018, but our follow-up story provides a rough indicator of what to expect.

Looking to sell your car? Sell it with Carro.

AI-generated Summary ✨

The comments mainly discuss the impact of the sales tax exemption on new CKD and CBU cars, with many seeing it as a temporary measure to stimulate economy and support car manufacturers and dealers. Some note that the actual price reduction for consumers may be modest, around 2.5-5%, and argue that high car prices in Malaysia remain a concern. There are concerns about whether the savings benefit the general public or mainly the wealthy, and mentions of how this could affect used car and recondition dealer markets. Several comments also criticize the overall high vehicle prices in Malaysia, government ownership of automakers, and the limited benefit for ordinary Malaysians, especially those deeply affected economically. Overall, opinions range from optimistic about economic stimulation to skepticism about genuine benefit for the average consumer.