Malaysia is keen on reintroducing a goods and services tax (GST) as it attempts to expand its revenue base and carry the weight of public subsidies. The move to reimplement GST, which replaced the sales and service tax (SST) in April 2015 but was then scrapped in favour of SST in September 2018 when the Pakatan Harapan government took over the reins, has been mulled before, but things are starting to sound a bit more concrete now.

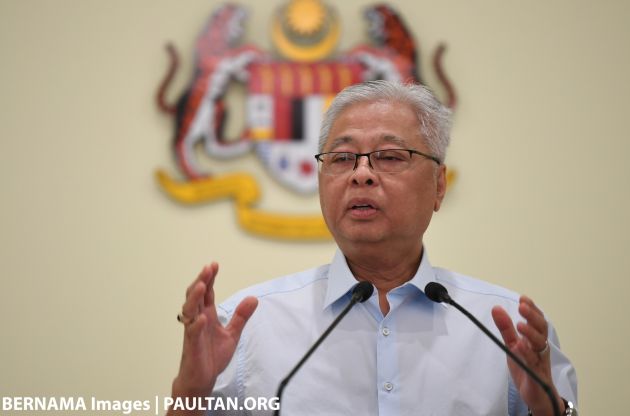

In an exclusive interview with Nikkei, prime minister Datuk Seri Ismail Sabri Yaakob said the country was deliberating the move. He said that the government is aware of the negative perception surrounding the GST, but added that it had limited options for replenishing the country’s coffers.

“We lost RM20 billion in annual revenue when we abolished the GST and replaced it with the old SST. No other country in the world has reverted back from GST to SST, except for Malaysia,” he told the publication.

Back in March, the finance ministry was said to be evaluating the reintroduction of GST as part of major fiscal reforms to strengthen the country’s revenue capacity. Bank Negara recently backed the idea of the GST being reinstituted, saying that it would relieve the heavy financial burden faced by the government.

The 6% consumption tax generally proved to be unpopular, with the public attributing it as a reason for rising living costs. Ismail Sabri said that this time around, the government would aim for a GST rate that was not so high that it would burden the people, but not so low that it “defeats the purpose of expanding tax revenue.”

He said the government would formulate ways to educate the public on the importance of the GST and transparent tax collection. “If we are going to reintroduce the GST, we have to educate the people to accept it,” he explained.

From an automotive viewpoint, it has been suggested that the reintroduction of GST could reduce car prices by between one and six per cent if it replaces the SST, which is currently charged at a rate of 10%. According to the Malaysian Automotive Association, the 2015 implementation of GST was proven to reduce car prices by as much as 6%.

However, as we reported late last year, the topic of car price adjustments in relation to new tax regimes is far more nuanced than what some observers will lead you to believe. While prices by and large did decrease somewhat when GST superseded SST in 2015, there were also some increases. And, there were also large-scale price drops when SST was reimplemented in 2018, so it’s not always set in stone.

As a quick recap, the GST is a value-added tax in which tax is paid in every stage of the business transaction versus SST’s one-time tax, which is paid by the manufacturer/importer. Despite that, the total amount of tax paid under GST is actually lower due to its input tax claim mechanism. In essence, the final GST quantum is borne by the consumer versus the SST, in which the quantum is paid by the importer or manufacturer.

Of course, in a hypothetical – and unlikely – scenario in which GST were to be introduced soon, with SST currently not being applied on new cars, GST coming in would see car prices going up, though not as high as before SST exemption was introduced, which seems like a very long, long time ago. Heck, we might even see another extension of the SST exemption, which is supposed to end on June 30. You never know, and never say never. Until July 1, at least.

For a more detailed look at the differences between the two tax regimes in relation to the automotive sector, read our comprehensive story on the matter from 2015. It will give you a better understanding on how GST affects car prices. Also, what do you think of the proposal to reintroduce GST on a wider scale, beyond just cars. Yay, or nay? Share your thoughts with us in the comments section.

Looking to sell your car? Sell it with Carro.

Basically just a pusing to tell you no sst exemptions extension. Use a news to cover the idea of extending it.

So,rakyat left with few options.

A.Be prepared to fork out more once GST kicks off

B.Dont buy new cars.Just repair current cars

C.Buy used cars..do your due diligence

Research shows,the euphoria of owning a new car dies off after a couple of months.So,is it always necessary to inflate MAA sales figures?

There are tons of recon and normal preowned cars available.Just take your time.You may discover a real gem in some of these preowned units.

More tax is to help rakyat

That’s Be-End storytelling

Ok what. People are now complaining there are too many cars out there now, everyday complain about congestion and jams. More taxes will help reduce the cars on the road and make life easier for all rakyat.

REMOVE FUEL SUBSIDY will solve traffic problems by 50-60% easy and effective. Let RON95 be RM4.50/L

PH cybertroopers working hard for the money!

Bring back GST. The only ones supporting SST are T20 businesses, cronies, vvips, and the criminal elements becuz with GST they cannot hide their income anymore that is where the bulk of GST income came from. Once revert back to SST all stop paying taxes which is why we lost RM 20Bil per year.

Let me finished paying my Outstanding cukai, then we can start talking abt GST…

Both first and second options are better.

Reasons

– Someone agree that urging that sst tax exemption as tax holiday must not continue forever and it is about time to put more tax to help rakyat

– Impose new cars that is didn’t follow lemon law

– Someone also agree that with more tax while ending sst tax exemption that will help lessen traffic jams

A is better. Bring back GST is better but reduce to 3% without any burdence not like GST 1.0

Not right!! If continues sst tax exemption, this will not be great idea, there will be more traffic jams in near future. That’s why solution is to end sst tax exemption.

Hidden due to lowcomment rating. Click here to see.

One smart Alex wil show again a “kangkung ” price before gst n after gst.

Fearing a huge backlash for removing fuel subsidies,the smart Alex decided to bulldoze GST.

Petronas just announced Rm23 B profits for 1 quarter.

So,petronas will hit Rm90B this year without any sweat.

So,if the ‘Bank of Last Resort” give Rm20-25B to fund fuel subsidies,are we asking too much?

So in this scenario,introducing GST would ‘seemingly”receive less backlash than total removal of fuel subsidies(except golden boys B40)

So,this is a brilliant game of survival of the fittest,according to Charles Darwin.

Far better than stupid idea of making cars more expensive for everyone to own except for their T20 vvips.

Rakyat will bring him to holland soon

If gst is going to be reintroduce it should be 10%

Hidden due to lowcomment rating. Click here to see.

Were we ahead of Singapore during the past 60 years?

The only country in the world that proven by its own parliament for abusing the GST refund account. Guess which one?

Hmm… can give a hint?

you on your own

Doesn’t mean we are getting another extension, if continuing SST tax exemption, this won’t be great idea, after all, will create more jams on many roads or highways. Solution is to end SST tax exemption

Should have stay with GST in the long term instead of reverting back to SST. GST is better and more efficient tax as compare with SST.

BN cybertroopers working hard for the money!

Previous government that were in power for 22 months are making bad move for downgrading from gst to sst

It was a total mess the last time they implemented GST!! They owed billions in refunds but never paid it back!! How to trust them when they are so inefficient!!

I don’t mind paying GST as long as the money is used for development and for the benefit of the people, but we know who the money is really for.

its different now. now we have proper mof from bank. last time pm was doubling as mof.

PH cybertroopers working hard for the money!

Yes, totally agree with you.

More for us to for out. More for 1 race and tge rest need to sufder. U morons has been stealing for decades nothing else. So now more to steal with unwanted units in bloated govt.

No to GST because the government do not have a mechanism to ensure quick return of money owed after implementation.

Because of those incompetent minister that was the time when first time implementing gst, can’t able to control well. But it is way different now, we have proper finance minister that will implement gst 2.0

All the BN supporters out there… “rindu zaman GST”.

to be precise, no country has gone from SST to GST back to GST and not going back to GST again. ya, two full cycles! it’s beyond U turn..we are literally running in circleS. and also the katak katak scenes are just the most amusing political show in the world!!! Damn speechless la whenever you all speak up with something.NOTHING ever good to make us proud of the government! Pui Betul.

Hidden due to lowcomment rating. Click here to see.

Its burden to peoples..

The Government shall focus to strengthen its productivity and performance in managing the economy on the background of global economic uncertainty and spiral cost of living especially wastages ie too many ministers and unnecessary spending ie overpriced contracts instead of looking shortcut another tax. Is not about the income but the issue here is how the Government used “the Rakyat’s Money” from Tax effectively

You are wrong. The poor execution of the GST affected the cash flow of many small business literally killed them. The Gov then under Najib and BN administration made it very difficult to claim back the money. This was very real and many people were affected. T20 and Helangs won’t be affected in anyway.

I don’t mind with GST if our gomen knows how to manage it well. Our gomen only knew how to collect monies but monies needed to return to companies were very hard to get. Companies might go bankcrupt if do not have enough cash flow. More borrowing from banks as well.

And our 6% is very high. 3% is better. But again, gomen need to return the monies owed to companies in a timely manner like companies paid GST also in a timely manner. It is really unfair to drag the GST return to companies.

The monies get from the GST must be well managed for our development and not masuk kocek sendiri. Faham2 ajelah jika makan cili terasa pedas.

Yeah but how many times we buy car in 5 years time???;inam nor concern on car but rather I am more concern on the GST on our daily consumption. The prices of goods already high and add another GST. It would be another wammy!. For small time traders all these GST they have to swallow themselves. They cannot pass the GST back to customer. However big corporations can transfer the GST to consumers. This action will kill the small traders and sole proprietorship companies.

I buy new car every 2 or 3 years. Most real benz and BMW owner do this too. I mean the real owner not those wannabe agent buyer. Hahaha. Gst is a taboo in MY. Not sure why but have a feeling of resistant frm the largest grp of you knw who if it is introduced. They really hate Gst. Haha