In line with the six-month bank loan repayment moratorium under the Pemulih package announced by prime minister Tan Sri Muhyiddin Yassin on June 28, banks have begun announcing their moratorium programmes, similar to that offered during the first movement control order (MCO) last year.

Prior to this, financial institutions have continued to provide targeted repayment assistance to individuals impacted by Covid-19 and movement control orders. The moratorium is available to everyone, from individuals in the B40 and M40 segments and the top 20% earners (T20) to small and medium enterprises (SMEs) and micro enterprises.

Hong Leong Bank has announced available plans under its Payment Relief Assistance programme, and we take a look at that for car loans. For individuals (B40/M40/T20), the bank is offering two plans for customers to choose from, the first being a six-month deferment of instalments, and the other is a 50% reduction of instalments for six months.

Those interested in taking the moratorium from HLB and needing specific details can contact the bank at 03-79591888 or 03-76268899, or via e-mail at [email protected]. Applications can also be made via this e-Form.

An important thing to note is that opting for the moratorium will still incur additional interest charges. However, this extra interest is not compounded, but from the loan extension. The interest will vary according to your loan amount, remaining tenure and the agreed interest rate, so check with the bank for details.

The point to remember is that the moratorium is not a loan waiver – you’re not getting three or six months “free rental.” Instead, your payment is simply being deferred, with the loan tenure extended by six months as a result. As such, the total interest paid is higher simply as a result of the tenure extension.

Unlike targeted assistance, there is no need for proof of a pay cut or job loss, and no documents are required. Borrowers will still need to apply with the bank for the moratorium, and sign an amended loan agreement.

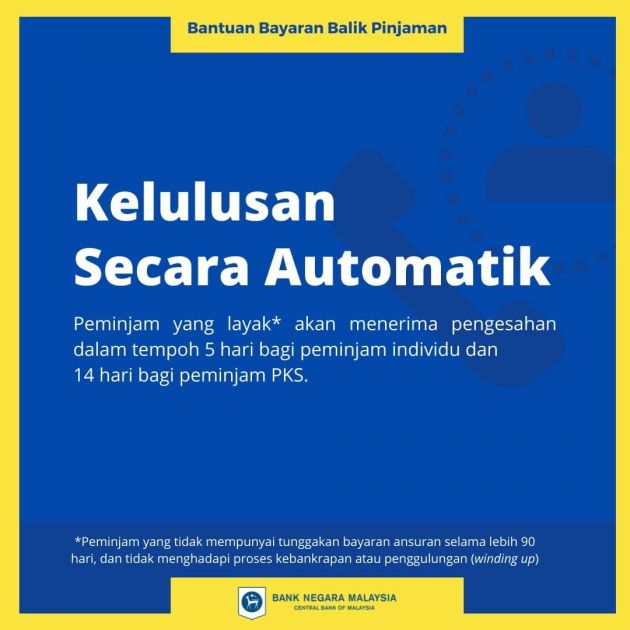

Approval is automatic for individual borrowers, while for companies it is subject to review by the bank and not automatic. According to Bank Negara, validation for individuals who qualify should take around five days, while for SMEs the period is two weeks. Also, accepting the loan pause will not affect an individual’s CCRIS status and rating, so there’s no need to worry.

Again, contact HLB via phone or e-mail (as listed above) for more details on its Payment Relief Assistance programme, or visit any HLB branch near you.

Aside from Hong Leong Bank, banks that have announced their Pemulih moratorium options include:

Looking to sell your car? Sell it with Carro.

Terjejas pendapatan kerana terpaksa menanggung keluarga yang tidak ada pekerjaan

Hutang > bangkrap

I see this round there is a bit more leeway & freedom to individual banks on how they would structure the Moratorium in a balanced way to serve their customers and investors.

Terjejas pendapatan kerana terpaksa menanggung keluarga yang tidak ada perkerjaan disebab covid 19

Terjejas pendaptan

Terjejas sebab menangung keluarga…pendapatan kurang..cukup2 utk tampung keluarga