Thanks to incentives put in place by the government, electric vehicles (EVs) are currently exempted from road tax from January 1, 2022 until December 31, 2025. Of course, all good things can come to an end, and while current owners will not need to pay road tax for a few more years, they (and future owners) will need to be prepared to pay from 2026 onwards.

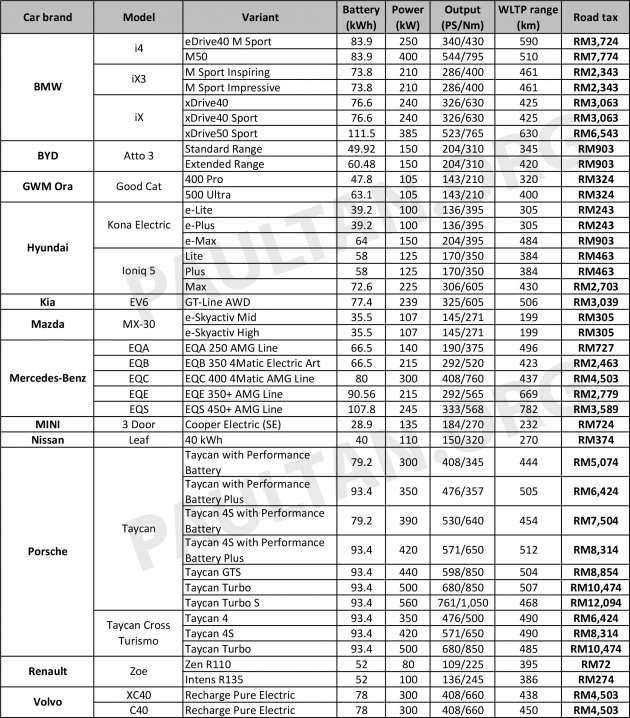

We’ve covered the topic of road tax for EVs in the past, but with a lot more EVs now on sale in Malaysia, we’ve done the math so you know how much the road transport department (JPJ) will charge. The calculations guidelines have been around for some time now – we covered it in 2019 – and it’s worth repeating how they work.

While vehicles with internal combustion engines have their road tax calculated based on engine capacity, EVs follow a kilowatt-based system. The final road tax amount for an EV is calculated based on the total power rating of the electric motor(s), with different power brackets determining the base rate and accompanying progressive rate (if applicable).

UPDATE: You can now use our EV Road Tax Calculator to calculate how much you would have to pay for your EV’s road tax in Malaysia.

At its most basic, EVs that are considered as private saloon motorcars – individual (code AB) and company registration (AC) – with a rated output of 80 kW and below have the following rates:

- 50 kW and below – RM20

- Above 50 kW to 60 kW – RM44

- Above 60 kW to 70 kW – RM56

- Above 70 kW to 80 kW – RM72

Beyond 80 kW, the road tax amount consists of two parts: a base rate plus a progressive rate. This is where most EVs in the market typically reside, and the rates are as follows:

- Above 80 kW to 90 kW – RM160 base rate with RM0.32 sen added for every 0.05 kW (50 watt) increase from 80 kW

- Above 90 kW to 100 kW – RM224 base rate, and RM0.25 sen added for every 0.05 kW (50 watt) increase from 90 kW

- Above 100 kW to 125 kW – RM274 base rate, and RM0.50 sen added for every 0.05 kW (50 watt) increase from 100 kW

- Above 125 kW to 150 kW – RM524 base rate, and RM1.00 added for every 0.05 kW (50 watt) increase from 125 kW

- Above 150 kW – RM1,024 base rate, and RM1.35 added for every 0.05 kW (50 watt) increase from 150 kW

Now, the department also has separate categories for private vehicles aside from saloon motorcars (such as SUVs) – individual (code AD) and company registration (AE). These follow the same power brackets as private saloon motorcars, but with different rates.

For private vehicles that are not saloon motorcars with a motor power rating of under 80 kW, the rates are as follows:

- 50 kW and below – RM20

- Above 50 kW to 60 kW – RM42.50

- Above 60 kW to 70 kW – RM50

- Above 70 kW to 80 kW – RM60

As for EVs with a motor power rating beyond 80 kW, the calculation is based on the following rates:

- Above 80 kW to 90 kW – RM165, and RM0.17 sen for every 0.05 kW (50 watt) increase from 80 kW

- Above 90 kW to 100 kW – RM199, and RM0.22 sen for every 0.05 kW (50 watt) increase from 90 kW

- Above 100 kW to 125 kW – RM243, and RM0.44 sen for every 0.05 kW (50 watt) increase from 100 kW

- Above 125 kW to 150 kW – RM463, and RM0.88 sen for every 0.05 kW (50 watt) increase from 125 kW

- Above 150 kW – RM903, and RM1.20 for every 0.05 kW (50 watt) increase from 150 kW

You’ll notice that the rates for fully electric non-saloon private vehicles (SUVs or jip as JPJ would classify them) are generally lower in most brackets, and this is also true of ICE cars too. In any case, the general rule is the higher the power output of an EV, the more road tax you’ll be paying.

It’s clear that EV owners will be paying quite a bit in road tax once the exemption ends when compared to owners of ICE cars. For some context, let’s compare an EV and ICE crossover (in the SUV or jip category) that are priced relatively similar.

We’ll use the BYD Atto 3 crossover, which retails from RM149,800 and will have a road tax of RM903 (delivered units currently show RM451.50 on their road tax, inclusive of the 50% discount announced in 2019, which is expected to expire by end of 2025 as well). Meanwhile, a similarly-sized HR-V in e:HEV RS guise with a 1.5 litre naturally-aspirated engine is priced at RM140,800, but the applicable road tax is 10 times less at just RM90.

Here’s another example with vehicles from the same brand. The Volvo XC40 as a full EV (Recharge Pure Electric) is priced at RM278,888 and its generous output of 300 kW means the road tax charge will be a whopping RM4,503. The same SUV with a 1.5 litre plug-in hybrid powertrain is priced at RM268,888, but the road tax is also RM90, or 50 times less! If you bring in the 2.0 litre mild hybrid variant into the picture that sells for the same amount, the road tax goes up to RM380, which is still considerably less.

Based on our table, the EV with the cheapest road tax post-2025 will be the Renault Zoe Zen R110, which has a power output of 80 kW that entails a flat rate of just RM72. The more powerful Intens R135 has a road tax charge nearly four times more as it has an output of 100 kW that puts it into a different bracket.

The Hyundai Kona Electric is second cheapest, with a road tax of RM243 applicable to the two variants priced below the RM200,000 mark, namely the e-Lite and e-Plus. Being a crossover, the Kona Electric would fit into the ‘private vehicles aside from saloon motorcars’ category, so it benefits from a lower progressive rate.

Other EVs with a three-digit road tax charge are the GWM Ora Good Cat (RM324), the Nissan Leaf (RM374), the Lite and Plus variants of the Ioniq 5 (RM463), the Mazda MX-30 (RM305), the Mercedes-Benz EQA (RM727) and the MINI Cooper Electric (RM724).

With EVs that have substantially higher outputs, the road tax charge goes as high as RM12,094 (as is the case for the Porsche Taycan Turbo S), which is the amount you would pay for a Lamborghini Huracan with a 5.2 litre V10.

Looking at the figures, we can’t help but consider the road tax calculation guidelines for EVs to be a little unfair. If the goal is to make EVs affordable for the masses, it’s not just the purchase price that needs to be considered, but also the cost of ownership in relation to road tax. Existing EV owners have voiced their concerns on the matter and called on the government to revamp the system in order to promote EV adoption.

However, it has to be said that in terms of pricing and affordability, EVs already have a massive advantage here in Malaysia by being virtually tax free to buy to begin with. Having to pay a slightly hefty road tax later on after a few years of free running seems fair enough, some would argue, especially taking into account the level of performance and the considerable weight of most EVs.

What are your thoughts on the matter? Should the road tax calculation guidelines for EVs be revised or are they fine as is? Get the discussion going in the comments below.

Yes, the current calculations for lesen kenderaan motor (LKM) EV is manifestly unfair & a deterrent to EV adoption.

We believe YB @anthonyloke can take this opportunity for a thorough revamp, and consider a "clean sheet" approach

— Malaysian EV Owners Club (MyEVOC) (@ev_club) January 26, 2023

GALLERY: JPJ road tax calculation guidelines for EVs in Malaysia

Looking to sell your car? Sell it with Carro.

“we can’t help but consider the road tax calculation guidelines for EVs to be a little unfair”

unpopular opinion: it is not that EV road tax is high. it is rather that ICE road tax is too low.

Actually agree with your comment, it’s true Malaysia road tax for ICE is too low.

We must ask ourselves, why we need EV ? Because we need to reduce air pollution and fossil fuel consumption, correct ? For reference, we can compare with advanced country like Britain, we see that ICE car owners there are paying extra road tax based on their car’s exhaust pollution (CO2, NO2).

But every few years, the UK govt narrows the tax bracket, meaning that the road tax keeps increasing every few years. So if you buy a new car there and keep it for 10 years, your road tax might double or even quadruple from Year 1 to Year 10 !

Bear in mind, this is very normal practice in UK, over 20 years already implemented. Even in neighboring Singapore and Thailand, they also have carbon-tax on ICE cars since the past 5 years at least.

Meanwhile in Malaysia, we still have on the roads (especially in kampung) many ancient 1990s Proton Saga / Wira 1.3 with carburetor that doesn’t even meet Euro 1 standard ! But still benefit from ULTRA CHEAP road tax… ONLY RM 70 !

Meanwhile, brand new Saga / Bezza 1.3 has fuel injection and VVT which meets Euro 4 standard. Fuel-consumption for brand new Saga / Bezza 1.3 is also much, MUCH lower.

So then, new 1.3 engine less pollution and jimat petrol, that means the road tax should be cheaper right ? Nope… STILL SAME RM 70 ! Where got fair like that bro ? Our road tax system got no logic lah.

So that’s why I strongly believe, if ‘new’ Malaysia govt cares so much about green politics and carbon neutral… they ABSOLUTELY MUST introduce carbon tax on all ICE vehicles, regardless if new or old.

Yes, this will mean many B40s will be priced-out of car ownership, which is why govt will need to provide amicable solution or upgrade path, like targeted RON95 fuel subsidy, cash rebate for new budget Perodua or Proton (Euro 4), free public transport pass etc..

B40 / M40 won’t buy EV now la

T20 won’t hurt for buying hi-power EV

i’m happy those t20 are buying EVs now. u need them to splurge.. then only EVs can become affordable :D

Don’t compare ICE road tax to EV ya..

COMPARE THE BENEFITS N MAINTENANCE THAT EV is much lower then ICE.. TAKE NOTE PLS

It will be interesting if paultan can calculate what the road tax will be for common ICE models in Malaysia based on the EV road tax kW structure.

In own opinion, we should road tax all cars based on kW rating.

Why don’t base on weight of the vehicle. Lagi berat, lagi senang jalan rosak, hence lagi mahal road tax.

I love that idea. It also encourages the use of small hatchbacks like the EU have or lovely little Kei cars instead of awful crossovers & SUVs.

However you will still have people whining how a Ferrari may be lighter than their X70 and how “unfair” it is that they are paying less roadtax.

don’t compare UK. people there don’t beranak like rabbits do like here. so small hatchback works there. not here

haiyaaa… not beranak banyak2 la. we malaysian cannot afford car, so 1 family need large car for 1 family until grandmother and father. if can include family in law also in 1 car. ahhahaha

I think the kw base calculation is fair but only if the ICE cars also being charged the same way.

Fully agreed. Road tax for all road vehicle shall be tax according to kerb weight and size of tyres.

Pergghhh..road tax ev mostly boleh beli motor sebiji punya harga(new/used)..nk galak,guna,ev apanya mcm tu..malaysia..malaysia..

So expensive… it doesnt pay to go green

green?? think again. the cost to produce the huge battery has already caused carbon emission higher than a regular ICE on the road for 10 years.

full ev is really for those filthy rich who are constantly trying to differentiate themselves from others.

remember nokia? who needs a PC on your palm? you could do everything with your pc at home

wrong. 10 years for big oil tanker to transport petrol to malaysia, oil truck to petrol station for your consumption is not green.

you are so wrong

pro fossil fuel advocate?

Not the right thinking here, the ongoing emissions from burning fuel in an ICE car is far higher than an EV over a cars lifespan. See https://www.epa.gov/greenvehicles/electric-vehicle-myths#Myth2

The idea of EV being toys for the rich is just because there are no EVs available at Axia prices, once they do exist though, it’s a no brainer to go EV for the benefit of your wallet (no maintenance costs, and assuming no tariff hikes your fuel bill will be cheaper too) and the environment

Unless we have a green alternative for coal, there is no way EV can completely replace ICE due to the amount of electricity required. Look them up. So ICE should be maintain to complement EV.

Check this TED Talk out and you’ll understand why. Full EV is not green. Your best bet if you really want to protect mother nature and leave the least amount of carbon footprint is to go hybrid. Not EV, especially those >400km range huge batteries.

https://www.youtube.com/watch?app=desktop&v=S1E8SQde5rk&si=EnSIkaIECMiOmarE

like i said, EV car is green because you can charge your car anywhere.

you dont need oil truck to transport petrol to your nearest petrol station.

ted talk = a bunch of starbucks sipping kids trying hard to impress people.

you comparing kids from ted talk with actual people doing R&D and producing cars and making billions a year?

heck, even toyota gave up on ‘hybrid’ and starting planning their EV cars.

you need a new script and if you are doing this propaganda for free, update your script.

USA China European car makers are not as smart as kids in ted talk, sureeee

Condescending. I’m not here to convince you. Good for you that EV is your religion. Now run along and enjoy your EV. You don’t need others to agree with you to justify your EV purchase and up-coming roadtax. Everything you read is your choice to believe. I’m not here to spread propaganda, merely to give food for thought to appreciative readers.

Not quite.. toyota is going for hydrogen engine

Unfortunately I found a problem with the video. The speaker analysed full EVs from three aspects of CO2 emissions:

1. Manufacturing (car and battery)

2. Fuel production (generating electricity)

3. Usage emissions (“tailpipe”)

However, he only analysed petrol-consuming vehicles from two aspects:

1. Manufacturing (car)

2. Usage emissions (“tailpipe”)

By leaving out analysis of Fuel Production (mining and refining petroleum), he has neglected a major source of included CO2 emissions, therefore his analysis is inaccurate.

road tax should be calculated based on power, torque, weight, emissions and annual travel distance . the higher of each factor , the higher the road tax as it is only fair that cars that damage the road more and polute more pay a greater share of the tax bill

Road tax mahal nak mampos!!

Hahaha…is the Govt serious on EV adoption??, this whooping road tax is a deterrent for ppl to adopt EV

Nope. You can still get a lower powered EV with a roadtax of under RM1k. They don’t want overly expensive and powerful cars getting away cheap tax

Insane !!!

langkah yg bagus agar akan ramai manufacturer buat EV utk marhaen, bukan EV utk besit2 bragging.

EV Road tax are more expensive than ice…

Yup… Malaysian EV industry will be dead by 2026…

xc40 buyers will start to cancel their orders.

Just to be clear this is a rule from 2019, before this gen of EVs were in the pipeline, it will definitely be revised. The revision probably won’t be too progressive like pollution or weight calculations, but should definitely bias low cost EV ownership and penalize ICE.

Please also implement ICE car roadtax based on hp or car value. Many rich people still enjoying low road tax for luxury car that having low cc. In return can reduce the road tax for low income people who are still using NA engine 1.6cc and below for example.

There are saving using EV cars. Perhaps Paultan should do a case study on saving comparison between using petrol and EVs. Paultan has huge readers, it is more responsible to portray balance review. Gov needs revenue when petrol revenue is dwindling but I still feels the road tax is cheap compared to saving from using EV.

The road tax for EV is so ridiculous. If you use internal combustion engine cc to determine road tax, why not use battery capacity of EV to calculate road tax? JPJ and Anthony Loke need to look into this now to have Malaysian adopting EV in the future.

LOL… EV buyers are SOOOO screwed. Kia EV6 – RM3k road tax? Seriously?? And even the hot-selling BYD.. RM900 road tax?! LOLLL… hybrids can deliver way more range at a lower road tax cost..

Well, if they can afford a 300K KIA…

First, charging is not cheap, especially charging outside!

Second, not easy to find a charging station now.

Third, worry about future maintenance costs.

Fourth, expensive road tax.

Fifth, EV is not really going green if you understand what their battery make of.

Sixth, even if I want to go green but I do not afford to contribute to it.

thats what nokia users said in 2010

According to your logic, nail clipper shouldn’t be exist

It would only be fair if the ICE cars also being charged by their power output as well as emissions.

Yes… charge ICE also the same price bracket, according to their kW/HP output.

Some outsource engine tuners may have to apply JPJ approval if they wish to modify/ECU remap to increase the HP output for a car.

Idiots government, EV car road tax very expensive, who can afford ? Think this is toys ?

actually, EV owners can afford it

JPJ has until 2025 to determine the correct tax bracket for all types of powerplant. If they are going to go with kW-based tax bracket, most ICE road tax will be following kW-based tax bracket.

It is just a matter of ICE road tax going to increase to match EV, or EV road tax going to decrease to follow small capacity turbo cc: power ratio tax bracket.

EV car prices are too expensive anyway. not bothered.

So high road tax, lagi takda resell value…hybrid is more practical

RIP EV Cars!!!!

Looking at the whole picture, it doesn’t say a lot. 1. Govt want to achieve net zero carbon but taxes people heavily thru EV car price and later thru road taxes. 2. Our public transportation system is not clear if we are fossil based or electric based or mixed? And no indication when we are achieving the nett carbon by means of transport fuel mix? 3. This EV and ICE debate is only in Kelang Valley. What about other cities in Malaysia? 4. Who is making the most from this EV thing? As for the consumers and users, they are being taxed the most.

As I said earlier the whole picture is not saying a lot

Road tax should be based on price of the car. Can afford to buy expensive EV but no money to pay road tax. Just damn pathetic. EV generally are more powerful and the higher the power, the more expensive it is. Anyway, I think the current scheme for road tax calculation is fair enough.

Ayoyo.. people won’t buy EV 2026 onwards..

nokia also thought their symbian is better

Policy drives EV adoption. The government is not serious about going green via full EV in Malaysia with this level of road tax.

Perhaps they can do what HK does with their one-for-one replacement scheme. If you de-register/scrap an ICE then you get tax rebate. Extend that to road tax as well.

What then tends to happen is you take off the road the worst emitting vehicles because they are cheap. Looks like a win win to me.

Buntu..we goin green meh?

Guess gonna cough up C02 off my 20years old satria for another 10years!

Road tax high, high charging cost by minutes, not much EV charger, not easy to install charging outlet at condo, sure no RV. I will stick to ICE as long as our petrol cheap hehe

Why tax based on range. Should stick to tax based on power output la. ♂️ Why the policy maker soo stupido. Tax based on range make the car maker happier provide crappy/lower battery tech to cheaper car. In the end the low end market get WORST RANGE at higher price compared to ICE. M40 and B40 to suffer.

Gov got no brain?

tak pernah paham how Msia roadtax system ni, totally merepek, current roadtax dari zaman dinasour x tukar and kelakar but msians takde choice. soon nak beli EV…..roadtax dah mcm pakai V8 4.0 above. belum lagi price charging the car per kw . i give up

Ridiculous, Msians have been paying premiums on road tax for ages due to the stupid JPJ calculation system. And now EV estimated cost roadtax,,,,,boleh mampus to own a car in future. Every month also negative carry since inflation hit us,,,,good luck Msia

haiyaaa… all the t20 and top m40 please go to EV la, so i can buy conti car which is use fuel with cheaper price… haiya… until now only afford to buy cheap konti. sudah la recond, secondhand lagii… hahahhaha

government look like not support people buy EV in Malaysia ,more tendency to pollute the environment.

I want to know who is advising YB Anthony Loke. This person need to learn about comparative studies. Here, I am using my Bezza 1.3A with 71kw and r/t = RM 70. Now, look at Nissan Leaf 110kw and r/t = RM 374. Thus, r/t for Leaf should be about RM 110, based on kw.

IMHO, the r/t for EV should be based on RRP. This means the r/t is proportional to RRP. Of course, there must be multi-level r/t similar to current system.

government should consider, eventhough the highpower motor of the EV car used for the roadtax calculation, they should know that EV owner could not make use of it to accelerate much as we accelerate, it consume much electric and the driving range become significantly shorter. It is inconvenient to the EV owner to frequently charge the EV because not much charging facilities in Malaysia. Some more the charging rate is very-very high price for the DC fast charging. I appreciate the cheaper roadtax as EV owner not produce pollution as ICE car does.