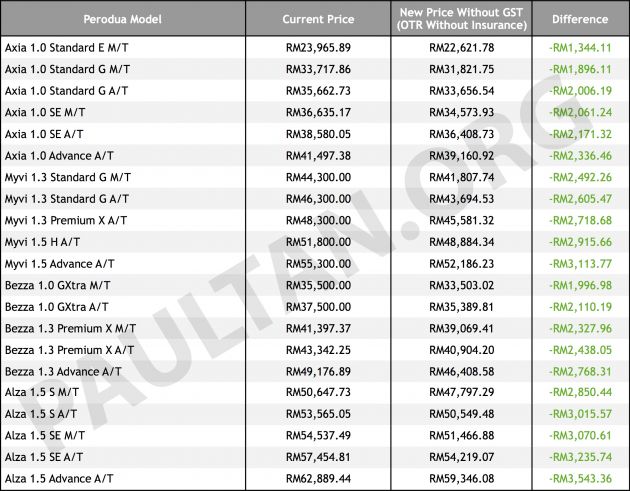

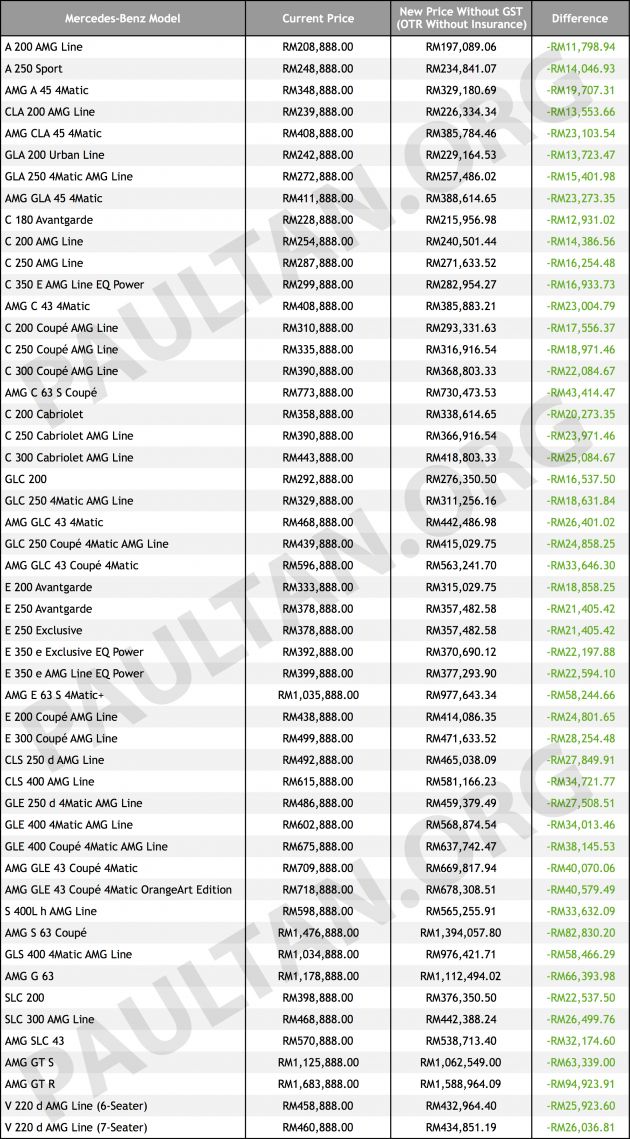

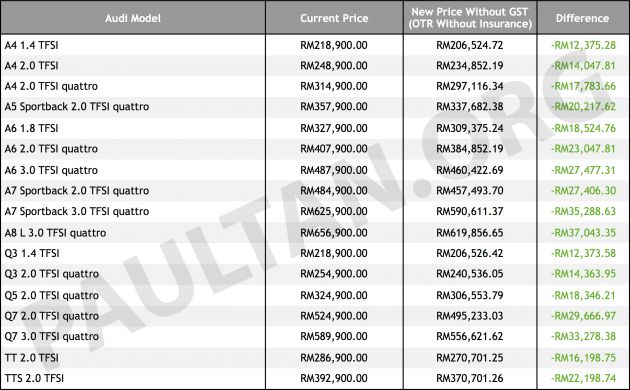

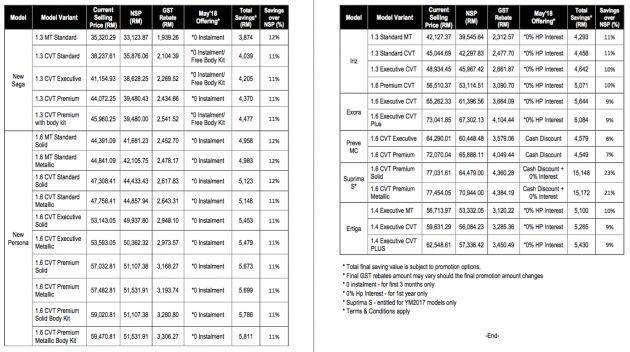

Proton has released a new price list that will come into effect from June 1, when the goods and services tax (GST) will be rolled back to 0% from the current 6%. The effective removal of GST was announced by the new Pakatan Harapan government last week, fulfilling a major campaign promise.

These new prices – which are on-the-road excluding insurance – will remain in effect until the sales and services tax (SST) comes back in to replace GST. The change will happen “in two, three months” time according to Tun Daim Zainuddin of the government’s Council of Eminent Persons. That’s a fairly long tax holiday, should you want to take full advantage.

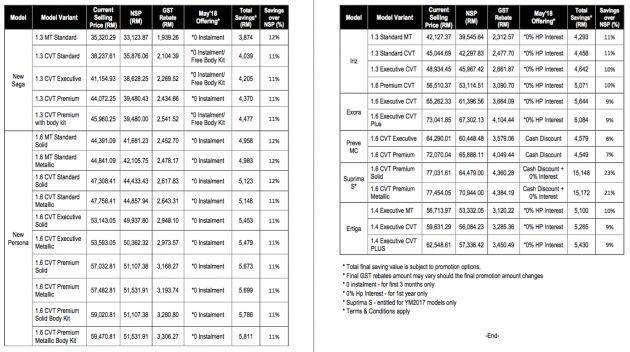

Without GST, savings range from RM1,939 for the Saga 1.3 MT Standard to RM4,384 for the Suprima S. There are usually slight variations in the percentage of reduction, which is typically slightly less than 6% flat. This is because 6% GST is only applied on the selling price of a car, before GST-free registration essentials such as road tax, registration fee and ownership endorsement fee are added on.

In Proton’s case, the current selling price is the standard OTR inclusive of 6% GST but excluding insurance figure, but the “NSP” you see here is the net selling price without OTR costs and accessories. “Total savings” include interest rate savings from the 0% promo. Note that the chart below has an error – the NSP for the Suprima S Premium Solid is RM70,545.57.

Click to enlarge

Proton first responded to the GST rollback on May 17, when it said that service vouchers equivalent to the price difference will be provided to customers who purchase from May 16-31, before adding one day later that it will also offer the option of cash rebates. That remains, so one does not have to wait till June 1 to purchase.

In addition to GST-related savings, Proton is having its Kosong-Kosong promotion. The campaign offers 0% first year financing for selected models with Hong Leong Bank (Iriz Executive and Premium, all Ertiga and Exora variants), free three months instalment with Proton Commerce (Persona and Saga, variants of the latter also with free bodykit) and discounts of up to RM15,172 for the YM2017 Suprima S. Add GST savings to the C-segment hatchback and it will be 23% off the list price. Full list of carrots according to model above.

New car sales aside, Proton is offering a 6% discount for after sales (labour and periodical maintenance parts only), should you need to bring your car in this month.